BLOGS

AI Is Rewiring Global Investment – And India Is At the Heart of It

July, 2025

The world is in the midst of a profound digital transformation—and at the heart of this revolution is Artificial Intelligence (AI). From redefining how we work to how we consume services, AI is influencing every sector, and its ripple effect on global investment is both significant and irreversible.

Unlike traditional sectors affected by slowing trade and geopolitical instability, AI is creating momentum in the opposite direction. Global capital is actively seeking high-growth, scalable infrastructure that can support the computational needs of AI, machine learning, and advanced analytics.

As a result, we are witnessing an unprecedented surge in investment across data centres, semiconductor manufacturing, and AI-specific infrastructure. And standing at the crossroads of this shift is India—a nation whose scale, talent, and digital ambition position it as a key player in the global AI ecosystem.

India, along with Singapore and Malaysia, has emerged as a preferred destination for this new wave of infrastructure investment. What sets India apart is not just its size, but the strategic steps it has taken to turn AI into a national opportunity.

The Global AI Investment Surge

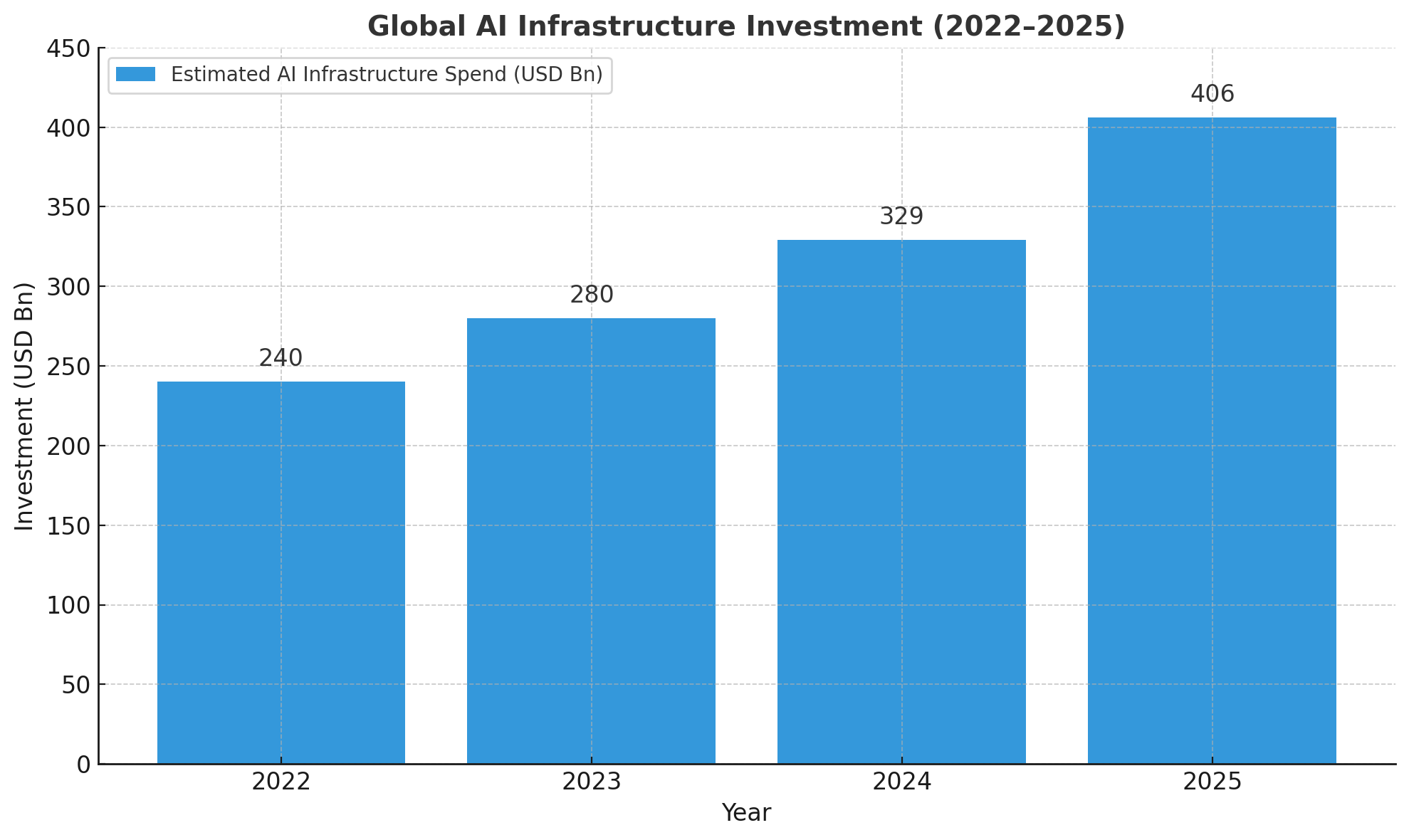

Over the past three years, AI has moved from an emerging trend to a central force shaping capital flows, infrastructure planning, and global technology policy. Post-2022, with the explosion of generative AI models, cloud platforms, and data-driven services, global investors have recalibrated their strategies.

Multinational tech companies are no longer only investing in AI applications—they are actively financing the physical and digital infrastructure that powers AI: from data centre campuses and GPU clusters, to fabless semiconductor hubs and AI model training labs.

This shift is especially significant because it comes at a time when other forms of cross-border investment are facing challenges. Trade tensions, shifting geopolitical alliances, and inflationary pressures have all dampened capital movement in many sectors.

But AI is bucking that trend. Major global players—particularly from the U.S.—are expanding outward, building in markets that offer cost efficiency, talent availability, and favourable regulatory environments. The result? A redirection of capital into Asia, and more specifically into India, Singapore, and Malaysia.

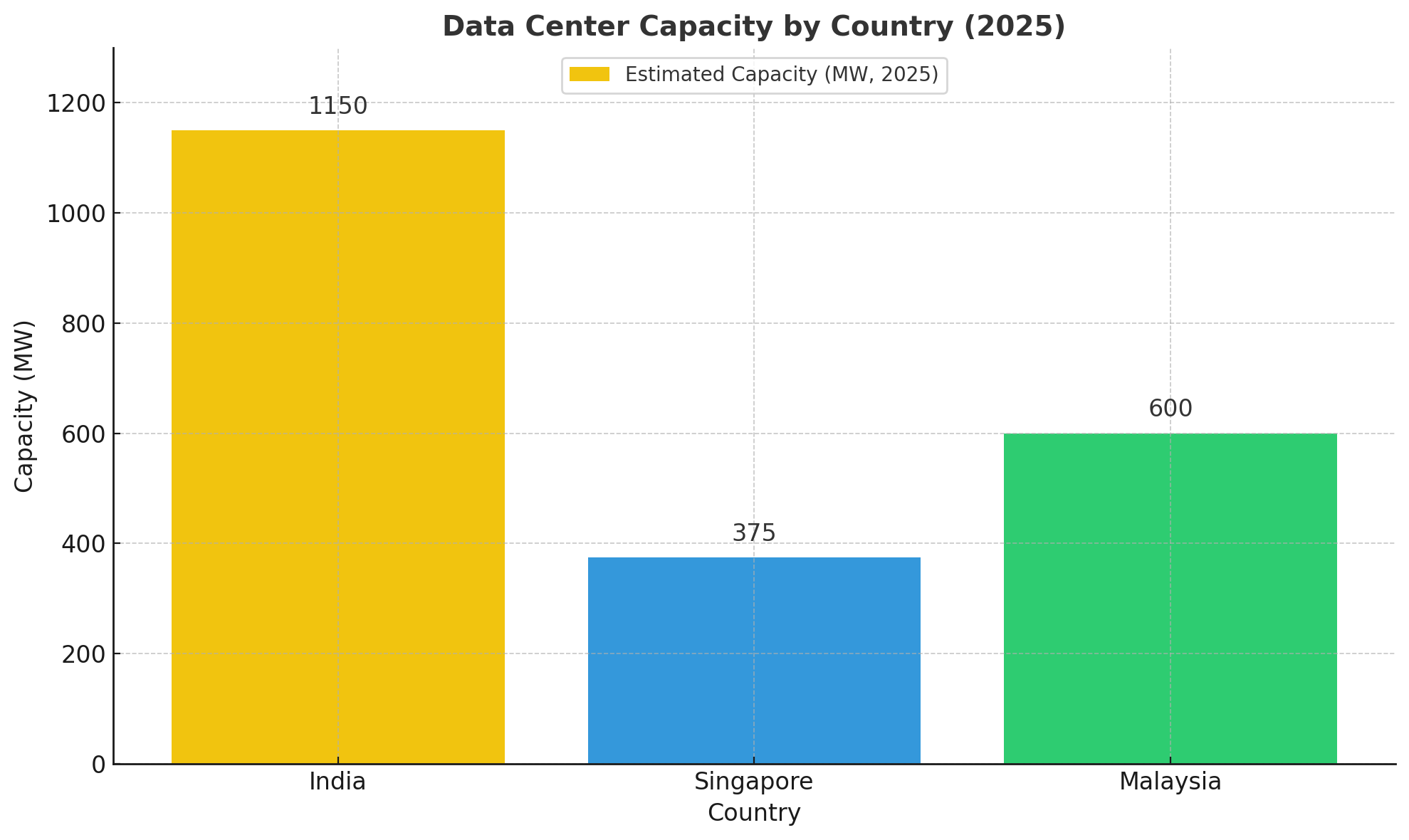

India, Singapore, Malaysia: The New AI Triangle

The emergence of India, Singapore, and Malaysia as the top three AI infrastructure destinations in Asia is no coincidence. These countries have consciously aligned their national strategies to become global AI-ready economies.

Singapore

Singapore offers regulatory clarity, world-class connectivity, and a compact, controlled environment for high-density data infrastructure. It is a leader in edge data centres, financial AI applications, and AI ethics frameworks.

Malaysia

Malaysia provides land and power cost advantages and is positioning itself as a complementary hub for both data centre hosting and semiconductor assembly. Strong government support and proximity to mature digital markets like Singapore and Indonesia strengthen its position.

India

India, however, stands apart. Its size, diversity, and policy depth give it the potential to become the long-term anchor for AI infrastructure in the region. India brings together:

Scale: A massive and growing digital economy with hundreds of millions of connected users.

Talent: One of the largest pools of software engineers, data scientists, and AI researchers.

Policy Support: National missions and incentives that align closely with global investor needs.

India is not just part of the triangle—it is becoming the gravitational centre around which the region’s AI infrastructure is being built.

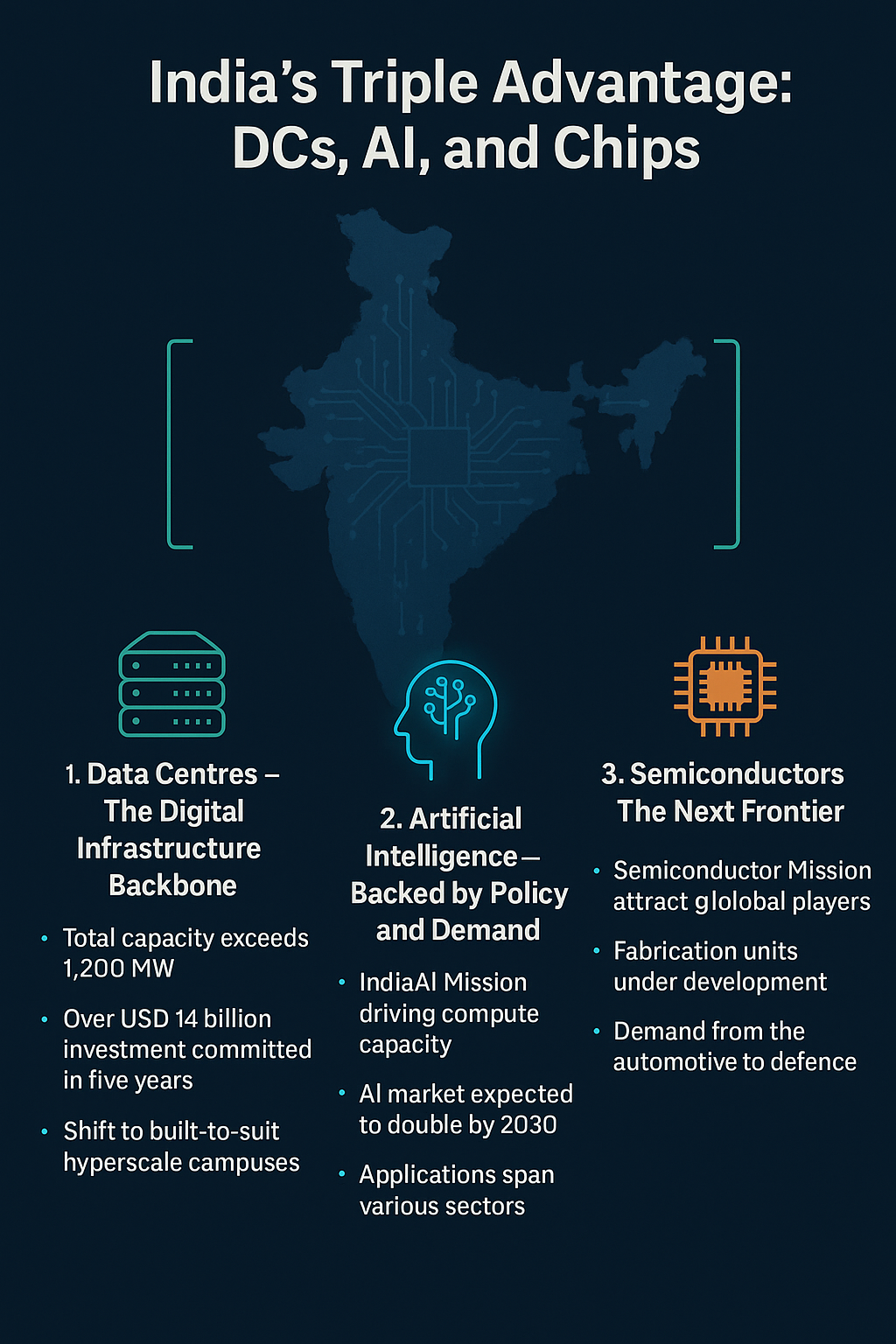

India’s Triple Advantage: DCs, AI, and Chips

India’s leadership in the AI investment landscape is built on the convergence of three high-growth verticals:

1. Data Centres – The Digital Infrastructure Backbone

- - India’s data centre industry has grown exponentially. As of 2025, total capacity exceeds 1,200 MW—more than 2.5x the capacity in 2020. This growth has been driven by hyperscalers, cloud service providers, and OTT platforms, as well as enterprise demand from banking, healthcare, and manufacturing.

- - Major cities like Mumbai, Chennai, and Hyderabad dominate, but Tier II locations such as Pune, Kochi, and Jaipur are quickly emerging.

- - Investment commitments from global players have crossed USD 14 billion over the past five years.

- - There is a growing shift from traditional co-location to built-to-suit (BTS) hyperscale campuses

2. Artificial Intelligence – Backed by Policy and Demand

- - India’s AI sector is growing in both size and sophistication. The launch of the IndiaAI Mission has created momentum around:

- - Building national compute capacity, including GPU clusters.

- - Encouraging responsible AI frameworks that are inclusive and scalable.

- - Supporting start-ups and deep-tech innovation through funding and access to public data.

- - India’s AI market is expected to nearly double by 2030, touching USD 17 billion. AI applications are now central to digital health, agriculture, financial inclusion, and smart manufacturing initiatives across the country.

3. Semiconductors – The Next Frontier

- - While India has traditionally been dependent on imports for semiconductor needs, this is changing. The India Semiconductor Mission and accompanying incentives have attracted both local and global players.

- - Fabrication units, assembly lines, and chip design centres are now under development across Gujarat, Maharashtra, and Tamil Nadu.

- - The government is encouraging public-private partnerships, and offering fiscal support and single-window approvals.

- Demand is coming from sectors like automotive, telecom, consumer electronics, and defence.

Together, these three domains are laying the foundation for India’s emergence as a complete AI infrastructure destination—from data and compute to processing and storage.

Capital, Infrastructure, and Policy Momentum

India’s rise as a global hub for AI-linked infrastructure is no accident—it is the result of a coordinated policy push, strategic incentives, and a fast-maturing digital ecosystem.

Over the past five years, the Indian government has taken decisive steps to attract long-term investment into data centres, semiconductor fabrication units, and AI research. Key policy moves include:

- Infrastructure status for data centres (over 5 MW), enabling easier access to long-term financing and improved FDI inflows.

- The Digital Personal Data Protection Act, 2023, which—while not mandating localised data storage—provides regulatory clarity by allowing cross-border data transfers to notified countries. This has eased compliance for global players, even as the demand for in-country data centres continues to grow due to latency, performance, and sector-specific data governance requirements.

- The IndiaAI Mission, focused on building GPU infrastructure, AI skill development, and ethical governance.

- PLI schemes (Production Linked Incentives) and state-specific tax and land benefits aimed at boosting chip and electronics manufacturing.

Additionally, India’s digital public infrastructure—Aadhaar, UPI, ONDC—continues to generate vast datasets that create new use cases and fuel the AI ecosystem.

Sustainability has also become a strategic driver. The doubling of green-certified data centre capacity, adoption of advanced cooling technologies, and integration of renewable energy reflect a future-forward approach to infrastructure development.

Outlook: What’s Next?

India is well-positioned to become a global AI infrastructure powerhouse by 2030. Key trends shaping the next phase include:

- Tripling of data centre capacity, reaching around 4,500 MW and 55+ million sq. ft. of developed space.

- Rise of Tier II and III cities as new hubs for edge computing, regional cloud nodes, and modular data parks.

- Expansion of chip ecosystem, with India becoming a serious player in packaging, testing, and eventually fab production.

- Adoption of AI-specific architectures in data centre design, such as AI-ready GPUs, low-latency fiber networks, and scalable storage solutions.

Investor appetite continues to grow—driven by sovereign funds, private equity firms, and large cloud providers—who now view India as a long-term strategic play.

In parallel, regulatory frameworks for AI use, privacy, and cross-border data flows are evolving, creating confidence and clarity for international businesses.

India is not just catching up—it is setting the pace for responsible, resilient, and inclusive AI infrastructure.

Conclusion

In an era defined by technology, AI is no longer a vertical—it is the horizontal thread that connects everything from healthcare and manufacturing to retail and governance.

India’s unique convergence of scale, policy support, talent, and market demand positions it as a cornerstone of the global AI infrastructure narrative. From building next-generation data centres to enabling secure chip production and driving GenAI adoption, India’s trajectory is clear—and it’s upward.

At Woodkraft, we are proud to contribute to this national transformation. With deep expertise in integrated design, engineering, and construction, we are enabling the physical infrastructure that powers the digital future.

If you are a hyperscaler, a global enterprise, or a policy-maker looking to build in India—now is the time. And we’re here to help you lead the way.

Data and insights in this article have been sourced from primary research and industry reports by Moody’s Analytics, and the Ministry of Electronics and Information Technology (MeitY), along with policy inputs from the India Semiconductor Mission, the Digital Personal Data Protection Act, 2023, and the IndiaAI Mission framework.

Stay inspired, stay informed, and stay connected with Woodkraft.

Follow Woodkraft on LinkedIn for the latest updates and inspiring workspace solutions.